In the ever-evolving world of financial markets, mt4 forex trading Best Trading Brokers play a crucial role in connecting traders with opportunities. One of the most popular platforms used by traders, especially in Forex trading, is the MetaTrader 4 (MT4). In this article, we will delve into the nuances of MT4 Forex trading, covering everything from basics to advanced strategies that can enhance your trading efficiency and profitability.

Understanding MT4: The Basics

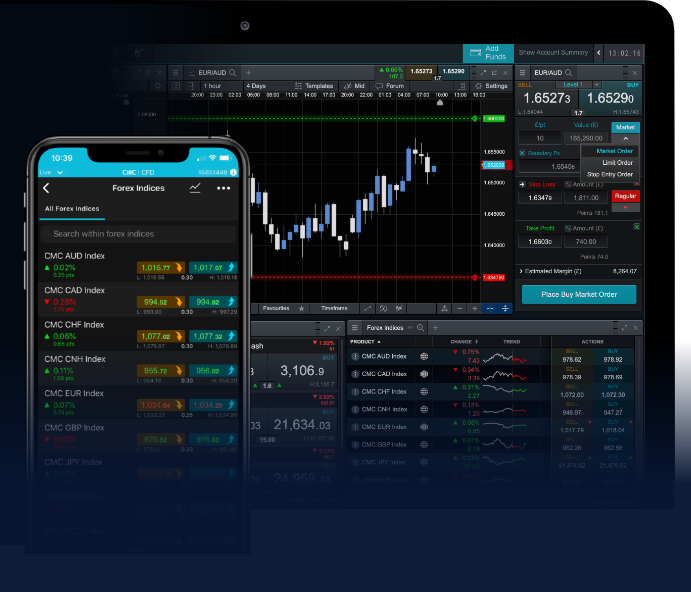

MetaTrader 4, commonly referred to as MT4, is an electronic trading platform widely used for trading Forex, CFDs, and other financial instruments. Launched in 2005 by MetaQuotes Software Corp., MT4 has become the platform of choice for millions of traders around the globe. Its user-friendly interface, customizability, and extensive capabilities make it suitable for both beginners and expert traders.

Key Features of MT4

MT4 offers a range of features that enhance the trading experience:

- User-Friendly Interface: The platform features a straightforward interface, allowing users to navigate easily through various functions.

- Multiple Charting Options: Traders can analyze market trends using various charting tools, indicators, and time frames.

- Automated Trading Capabilities: Through Expert Advisors (EAs), traders can automate their trading strategies, allowing for trades to be executed without direct intervention.

- Customizable Indicators: Users can develop and integrate their own indicators and trading scripts, tailoring the platform to their individual trading needs.

- Mobile Compatibility: MT4 is available on various devices, including smartphones and tablets, ensuring traders can monitor their positions on the go.

Getting Started with MT4

To begin trading on MT4, follow these steps:

- Choose a Forex Broker: Selecting a reliable broker is vital. Ensure your broker offers MT4 as a trading option and is regulated by a reputable authority.

- Download and Install MT4: After registering with your chosen broker, download the MT4 platform and follow the installation instructions.

- Create a Trading Account: Once installed, open the platform and create a demo or live trading account. A demo account is recommended for beginners to practice without financial risk.

- Familiarize Yourself with the Platform: Explore the features and settings of MT4, including how to execute orders, set stop losses, and analyze charts.

- Develop a Trading Strategy: Before trading with real funds, develop a well-structured trading plan that outlines your risk tolerance, trading style, and specific goals.

Trading Strategies in MT4

Successful trading in Forex requires a comprehensive strategy tailored to your trading style. Here are some popular trading strategies that can be implemented using MT4:

1. Scalping

Scalping involves taking advantage of small price movements by making numerous trades throughout the day. This strategy requires quick decision-making and the ability to react rapidly to market fluctuations.

2. Day Trading

Day trading involves opening and closing trades within the same trading day. Traders analyze daily price movements and utilize various technical indicators to make informed trading decisions.

3. Swing Trading

Swing trading focuses on capturing price swings in the market over several days or weeks. Traders use technical analysis to identify trends and potential reversal points.

4. Position Trading

Position trading is a long-term strategy where traders hold positions for weeks, months, or even years. This approach focuses on fundamental analysis and broader market trends.

Technical Analysis in MT4

Technical analysis is a critical aspect of Forex trading, and MT4 provides various tools to facilitate this analysis:

- Chart Types: MT4 supports multiple chart types, including line, bar, and candlestick charts.

- Indicators: The platform offers numerous built-in indicators such as Moving Averages, RSI, MACD, and Bollinger Bands.

- Drawing Tools: Traders can use trend lines, Fibonacci retracements, and other drawing tools to enhance their chart analysis.

- Alerts and Notifications: MT4 allows traders to set alerts based on specific market conditions, helping them stay informed on price movements.

Risk Management in Forex Trading

Effective risk management is crucial for long-term success in Forex trading. Here are some risk management techniques you can implement in MT4:

- Use Stop Loss Orders: Setting stop loss orders helps protect your capital by closing trades at predetermined levels.

- Diversification: Spread your investments across different currency pairs to mitigate risk.

- Position Sizing: Determine the appropriate position size based on your risk tolerance and the size of your trading account.

- Regularly Review Your Trades: Analyze your past trades to identify patterns, mistakes, and areas for improvement.

Conclusion

MT4 has revolutionized Forex trading by offering a robust platform with diverse functionalities. By understanding the features of MT4 and developing effective trading strategies, traders can navigate the Forex market with confidence. Whether you’re a beginner or an experienced trader, utilizing the proper tools and strategies within MT4 will be essential to achieving success in your trading journey. Always remember that continuous learning and adaptation to market changes are keys to long-term success in Forex trading.